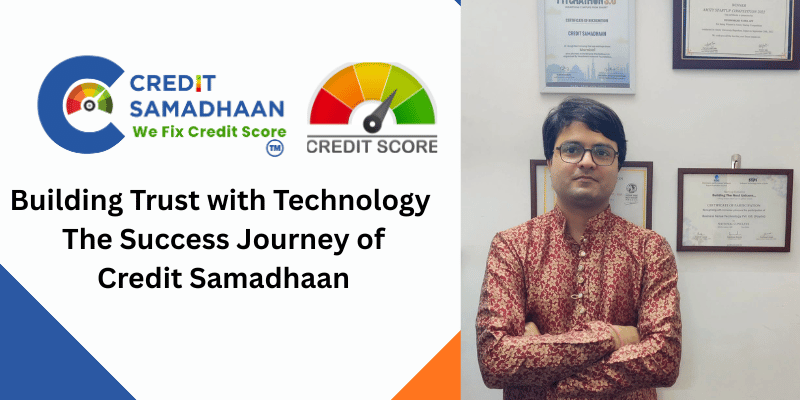

In Indore, a remarkable story is unfolding. Without flashy campaigns or big promises, one entrepreneur is quietly transforming how Indians deal with credit, debt, and financial rejection.

From Early Struggles to Entrepreneurial Success

Piyush Nagar faced hardship early in life — losing his father at 8, working odd jobs like selling ice candies to support his family, yet never abandoning his dream to study. His determination paid off when he became an engineer and later built Sixth Sense IT Solutions, a tech company now serving 4,000+ clients worldwide.

But even with global success, one question stayed with him:

Why do so many hardworking Indians get rejected by banks simply because of their credit scores?

An Alarming Realization

While on a village project, Piyush discovered something shocking — of 1,00,000 loan applications, nearly 99,300 were rejected due to low credit scores. These weren’t fraudsters, just everyday people who lacked awareness of how credit works.

That moment sparked a mission.

The Creation of Credit Samadhaan

Piyush launched Credit Samadhaan, an AI-powered platform designed to scan credit reports, find errors or weaknesses, and create an actionable plan for users to improve their scores. Results come fast — many users see progress within 45 days.

But Piyush didn’t want the solution to remain only digital.

Credit Kendras — Where Tech Meets Human Guidance

To make support accessible, he established Credit Samadhaan Kendras in 18 states. Here, trained Credit Coaches help people understand credit and take steps toward rebuilding their profiles.

These centers do more than fix numbers — they:

- Empower farmers, shopkeepers, and families.

- Spread financial literacy.

- Create local jobs by training new Credit Coaches.

Transforming Lives Beyond Finance

Credit rejections hurt more than just bank balances. They block dreams, create stress, and sometimes break confidence. Common struggles include:

- Farmers unable to buy seeds or machinery.

- Entrepreneurs denied growth capital.

- Families paying higher EMIs on home loans.

Credit Samadhaan restores more than financial health — it restores hope and dignity.

Recognition and Growth

The initiative has already gained support from IIM Ahmedabad, IIM Bangalore, and STPI, and has won recognition through Octane 5.0, Bharat Pitchathon, and the Tata Social Challenge (Top 50 Social Enterprises).

With investment from Inflection Point Ventures, Credit Samadhaan is scaling faster to reach millions more.

A Mission Beyond Business

For Piyush, this journey is deeply personal. He believes financial rejection impacts mental well-being as much as bank accounts. His mission is to:

- Reduce financial stress.

- Prevent debt-driven despair.

- Give people fresh opportunities.

Looking Ahead

With 1,000+ clients and 464 partners, Credit Samadhaan is rapidly growing. The goal: to ensure no Indian feels stuck or helpless because of a poor credit score.

A Story of Hope

This is not just about technology or business. It’s about resilience, compassion, and second chances.

Through Credit Samadhaan, Piyush Nagar is proving that technology, when guided by empathy, can change lives and give people the confidence to dream again.

👉 Learn more at: [www.creditsamadhaan.com]